Aligning Around MORPHO — The Only Asset For Morpho

TL;DR

Morpho will have only one asset—the MORPHO token. This single-asset approach ensures complete alignment between the network of contributing entities and the Morpho DAO (MORPHO token holders).

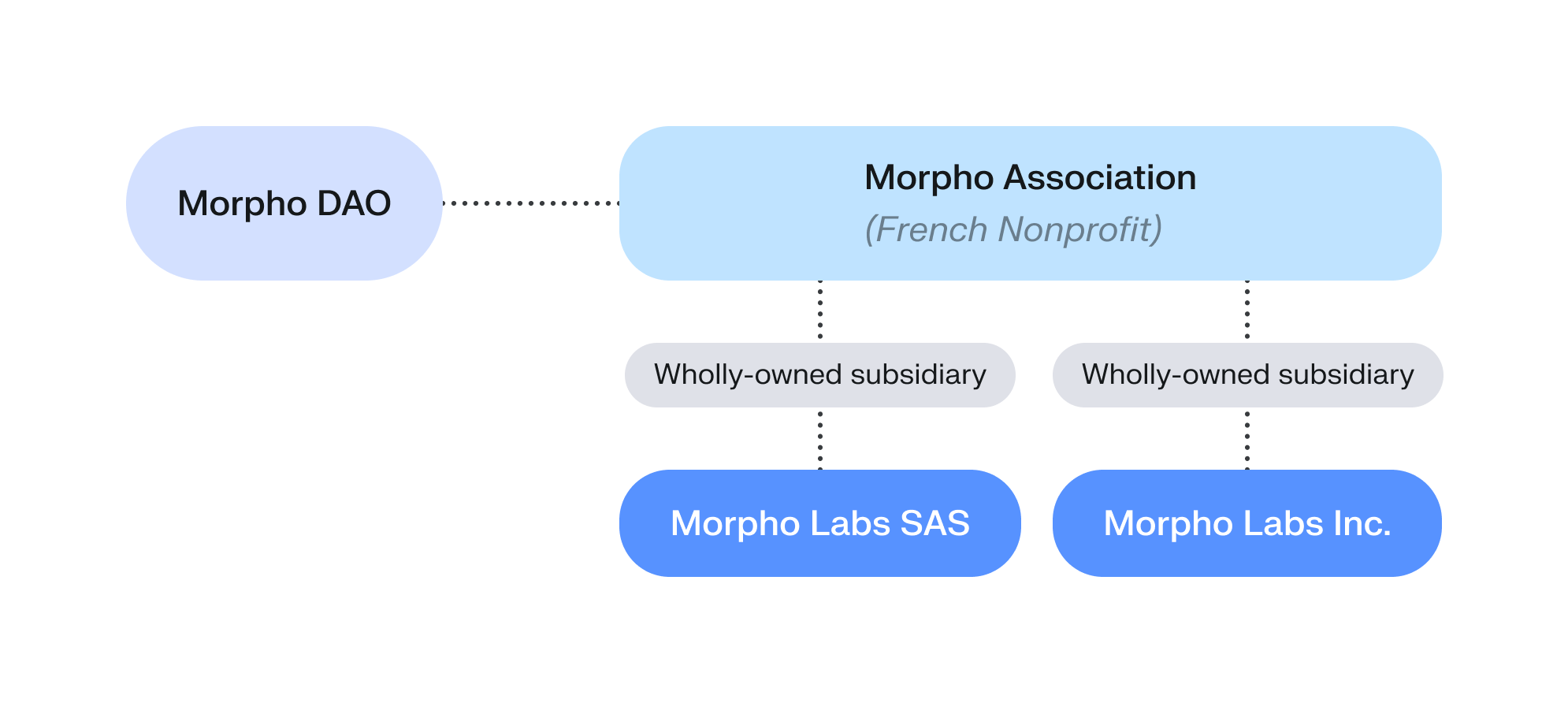

To clarify this alignment, Morpho Labs is becoming a wholly-owned subsidiary of the Morpho Association to eliminate any perceived conflicts with equity value, ensuring that token holders and contributors share the same incentives.

As the Morpho DAO explores introducing protocol fees to support network growth, the Morpho Association advocates for reinvesting protocol fees rather than distributing them, as reinvestment can generate exponentially more value for the network.

Mission & Structural Alignment

DAOs cannot legally execute offchain actions, contracts, or transactions, and rely on legal entities to act on their behalf. For Morpho, the Morpho Association serves this critical function, with a sole mission to grow Morpho’s network effects through research, development, and adoption.

This mission is both public and legally enforceable. As a French nonprofit organization, the Association is legally prohibited from having shareholders, distributing profits to its members, or being sold. All resources must be directed toward its stated mission.

To clarify and simplify this alignment, Morpho Labs SAS (a French joint-stock company) is becoming a wholly owned subsidiary of the Association through a 100% share transfer (subject to employee approval and other customary conditions), permanently eliminating the possibility of distributing any equity value externally.

Similar to Morpho Labs Inc., a Delaware C-Corp for hiring employees in the US and already a wholly owned subsidiary, Morpho Labs SAS will primarily exist for hiring employees in the EU.

This structure has two benefits. First, it guarantees that token holders and entities contributing to Morpho share the same incentives. Second, it streamlines the Morpho Association’s ability to execute its mission — growing the Morpho network.

Operating Like A Scale-Up

Crypto has embraced the idea that protocols should distribute fees to token holders just a few years after launch. But this mindset ignores a fundamental question: If you believe in a project’s long-term success, do you want insignificant distributions today or exponential growth tomorrow?

Morpho launched three years ago and is still relatively nascent compared to its ambition of replacing traditional financing infrastructure. Most, if not all, crypto projects share a similar reality. Despite some differences, they’re functionally equivalent to startups when viewed against traditional business lifecycles.

Would a high-growth startup distribute revenue to shareholders instead of reinvesting in expansion? The answer is almost universally no.

It even took many of the largest tech companies, including Apple, Meta, and Alphabet, 10 to 20 years before they started distributing dividends.

A crude framework is the following:

- High-growth projects with effective capital deployment: Reinvest for exponential returns.

- Mature projects with limited growth potential: Distribute cash so it can be invested elsewhere.

For Morpho, the choice is clear. Things might change in the future. But right now, we’re building a foundational network in a rapidly expanding market with significant potential. All revenue should be reinvested back into growth.